Charge-Coupled Devices (CCDs) have been

the dominant image sensors, but complementary metal oxide semiconductor

(CMOS) sensors are catching up fast, creating a big market opportunity.

CMOS received its name not by the specific type of sensor technology,

but by how the sensor is manufactured. The manufacturing process is

simple compared to the older technology. CMOS incorporates a

camera-on-chip technology, which allows customized multiple circuitry to

be added to the single chip without any supporting chips. There are two

types of CMOS sensors - passive and active. In the coming years, CMOS

sensors are expected to increasingly displace the CCDs that, until now,

have dominated the market for sensors used in products such as video

recorders, digital still cameras, handheld devices, and audio

equipment's.

Currently, CCDs have a large percent share of the imager market,

reflecting their past ability to outperform devices manufactured using

other technologies. However, CCD systems are more expensive, consume

large quantities of power, are inflexible in operation, and need an

array of supporting circuitry to function. In contrast, modern CMOS

image sensors have all the necessary electronics on the chip,

drastically reducing their size and power requirements and enabling them

to go significantly beyond the pricing, size, and power limitations of

CCDs. CMOS has the lowest power consumption of all the technologies in

existence today. As technology advances, the demand for lower power

consumption should increase. CMOS sensors can extend the battery life of

digital cameras, so that consumers can use them for longer periods of

time without recharging.

Potential Markets

According to Frost & Sullivan, the CMOS image sensor market will see

a compound annual growth rate of 33 percent and revenues are expected to

touch $4.64 billion by 2007, compared to 6.2 percent of the rival

technology, the CCDs.

|

Leading Players

|

Agilent Technologies,

Inc., is a corporation formed by the restructuring of Hewlett-Packard

Company. In October 1998, Agilent launched its CMOS sensors with a

digital imaging platform that would be modeled by many companies

entering the market. A little over a year later, Agilent celebrated the

shipment of its one millionth CMOS sensor. Agilent's market share proves

that the company is leading the CMOS sensor market in developing the

standards in fabrication. Many small independent companies are trying to

mirror Agilent's quality and cost-effectiveness.

In June 1998, Hyundai Electronics of Seoul, Korea announced its

development of CMOS sensors. Hyundai's CMOS sensor family uses 8-bit ADC

in features such as direct digital output, pan control, frame-rate

control, readout mode control, and automatic gain control.

ST Microelectronics is the world's third largest independent

semiconductor company. The company designs, develops, manufactures, and

markets a broad range of semiconductor integrated circuits (ICs) and

discrete devices used in a wide variety of microelectronic applications,

including telecommunications systems, computer systems, consumer

products, automotive products, and industrial automation and control

systems. In June 2001, ST Microelectronics announced the availability of

fully functional samples of a new CMOS read/write channel chip for hard

disk drives. It allows drive manufacturers to cut manufacturing costs,

reduces power consumption, and increases overall data transfer speeds.

The Future

The image sensor market is a growing industry with a strong foundation

provided by a sturdy CCD technology. The battle for market share in the

image sensor industry will be between CMOS and CCD. New applications

found in the automotive and hand held communication industries are

expected to be promising with the launch of CMOS. Some changes in the

growth rate are anticipated to occur with this launch. As demand for

these products increase, CMOS will end the market control that CCDs have

enjoyed... Advantage CMOS.

Cahners In-Stat Group, a Scottsdale, AZ-based market research firm, estimates that CMOS sensors accounted for just 7.2% of all image sensors shipped in 1999 and 6.2%, or about $62 million, of the industry’s $1 billion in worldwide sales. Yet by 2004, it forecasts, CMOS sensors will account for 50.8% of the units shipped, and 35.5% of revenues. Another market-research firm, San Jose, CA-based Frost & Sullivan, forecasts nearly 60% compound annual growth for the worldwide CMOS sensor chip market from 1998 through 2003, compared with 6.2% for CCDs. It expects market revenue for all types of image sensors to reach $1.7 billion in 2003.

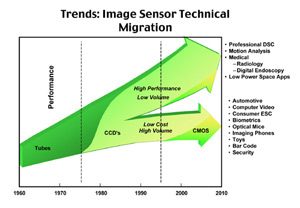

As the figure shows the current sensor market divides itself into two areas: the high-performance, low-volume branch, and the low-cost, high-volume branch. In the high-performance branch are applications that will continue to be dominated by CCD technology, but CMOS technology will find market share too, especially for lower cost or more portable versions of these products. The second area is where most of the CMOS activity will be. Here, in many applications CCD sensors will be replaced with CMOS sensors. These could include some security applications, biometrics and most consumer digital cameras.

Most of the growth, though, will likely come from products that can employ imaging technology—automotive, computer video, optical mice, imaging phones, toys, bar code readers and a host of hybrid products that can now include imaging. These kinds of products will require millions of CMOS sensors.